The 8th of November would be remembered as a day of demonetization in India which we call it notebandi. The dictionary meaning of demonetization is the withdrawal of a particular form of currency from circulation. On this day, PM Narendra Modi announced that 500 and 1000 denomination currency units will be invalid legal tender. Lets try to analyse a bit and understand was Demonetization a success or failure?

Demonetization – The Master Plan

This brave move was planned to tackle black money, scotch funds to terror groups which used fake notes and curb corruption. The 500 and 1,000 notes accounted for more than 85 percent of the value of cash in circulation which was worth around 15.4 trillion rupees, according to research firm Capital Economics.

RBI issued a circular on May 5, asking banks to dispense more Rs 100 notes through the ATMs. Images of Rs 2000 notes started doing the rounds on the internet but nobody knew the big plan. Only a few people were aware of this inside out.

Another idea was to reduce physical currency in the economy and substitute it with digital money. A cashless society would mean less investment in handling cash, transparency in payments and check on fake accounts, said Finance Minister Arun Jaitley.

According to a study conducted by the Indian Statistical Institute, this was a great move to eliminate fake currency as 250 out of every 10 lakh notes in circulation are illegal. Pakistan’s military spy agency, the Inter-Services Intelligence (ISI), has been raking in an annual profit of around Rs 500 crore by circulating counterfeit notes in India, according to a report prepared by the IB, R&AW, Directorate of Revenue Intelligence and CBI.

Demonetization – Cascading effect

According to an estimate, about 78 percent of all consumer payments in India are affected by cash. Common people mainly the economically weaker people had to bear the pain by queuing up outside banks day and night. Small traders were hit hard as their business was totally depended on physical money.

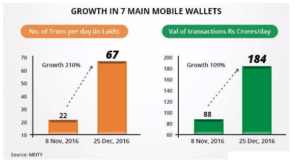

Digi dhan melas and lucky dips were organized to encourage people to embrace the digital economy. In December 2016 PM Modi introduced BHIM app a platform for digital transactions recorded 16 million downloads till July 2017.

In a document released by RBI in March 2017, it was stated that “Post-demonetization, 23.3 million new accounts were opened under the Pradhan Mantri Jan Dhan Yojana (PMJDY), bulk of which (80 percent) were with public sector banks. Of the new Jan Dhan accounts opened, 53.6 percent were in urban areas and 46.4 percent in rural areas.”

But the bigger picture does demonetization decision help government seize black money or stop terrorist funding.

99% of the scrapped money came back to the system. Former RBI governor Raghuram Rajan said a fair amount of unaccounted cash is typically in the form of gold and therefore even harder to catch. He further said that he would focus more on incentives that lead to the generation and the retention of black money.

In 2014-15, a total of 5.94 lakh counterfeit notes were detected as per RBI’s annual report. In 2015-16, this number went up to 6.32 lakh. But in the 8-month period between 09th November 2016 and 14th July 2017, only 1.57 lakh counterfeit notes were detected.

Former PM Manmohan Singh described November 8 as a “black day for economy and democracy”. Data released by the Ministry of Statistics show that GDP slowed to 5.7% in the quarter ended June 30, from 7.9% in the corresponding period a year ago. However, the sluggishness is expected to be less significant as the demand will re-enter the system once the situation becomes normal.

Manufacturing, mining, construction were the sectors adversely affected. These are the cash-intensive sectors that took the worst hit after the cash squeeze.

Advantages Of Demonetization

Finance Minister Arun Jaitley said we are largely a tax non-compliant society and Demonetization helped in widening the tax base. The government added 9.1 million new taxpayers in 2016-17, an 80% increase over the typical yearly rise, highlighting the impact of India’s November demonetization of high-value currencies.

In making a cashless economy demonetization played a major role. NPCI(National Payments Corporation of India) data shows that the Unified Payment Interface (UPI) transactions made a giant leapfrog from just 1,03,060 transactions in October 2016 to 91,67,277 transactions in May 2017.

Demonetization has caused an instant setback to the issue of Pakistan printed high-value fake currency note. Terror attacks down by 60 percent: According to government sources, the number of terror-related incidents has reduced by almost 60 percent in Jammu and Kashmir post-demonetization. The printing of fake currency has to be stopped. If the old notes could be counterfeited, so can the new ones too, despite having advanced features.