On 1st February, Friday, the Finance Minister Piyush Goyal presented the Interim Budget for the Fiscal Year 2019-2020 in the Lok Sabha of the Indian Parliament. He began with talking about the reversal of the ‘policy paralysis engulfing the nation’. Following it up by mentioning how the efficiency of the previous budget allocations have restored the image of the country. With these acknowledgements of the government’s works, he put forward the proposal of the Interim Budget 2019. Following are the key highlights of the budget and their analysis and prophesied impact.

Key Highlights of The Budget

Income Tax

Income Tax Rebate : FM Piyush Goyal stated that individual taxpayers with an annual income of upto RS.5Lakhs will benefit from a full tax rebate.

- Individual taxpayers with a taxable annual income of Rs.6.5Lakhs may also be exempted from tax.However, the prerequisite for this is to make investments in provident funds, specified savings(equities), insurance, etc.

- However, tax slabs for people with an annual taxable income above Rs.5Lakhs has not undergone any changes.

Benefits for the middle income taxpayers: The earlier tax slab was applicable to to individual taxpayers with an income of upto 2.5 Lakhs. But this increase in the tax slab is especially beneficial for the middle class citizens of the country as this increases the consuming power of the money they earn.

Defence

- Considerable increase in the Defence Budget: The Defence budget has been increased to over Rs.3Lakh Crore. The ‘One Rank One Pension’ scheme has been implemented by the Government while allocating Rs.35,000 Crore for this scheme.

- “The Government has also announced a substantial hike in the military service pay of all service personnel. Special allowances given to be given to Naval and Air Force personnel deployed in high risk areas,” stated Piyush Goyal.

Analysis: This year is the first time that the Government has allocated over Rs.3Lakh Crore for the Defence Budget. Moreover, the Government is also willing to bear extra expenses incurred in order to ensure a high degree of ‘preparedness’ at the Indian borders.This move is essential to better equip the Indian Army and and tighten the security at the borders of the nation.

Pension and Income Support Schemes

- Proposed to launch a Mega Pension Yojana, namely, Pradhan Mantri Shram Yogi Mandhan. It suggests to provide a monthly income of Rs.3000 to workers employed in the unorganised sector. This pension can be availed by retired workers above the age of 60. Any worker joining the scheme at 59 years of age will only have to contribute Rs.100 per month.

Analysis: This is aimed to benefit around 10crore workers employed in the unorganized sector. It has the potential of becoming the world’s biggest pension scheme in the unorganized sector. This can be achieved in the coming five years.

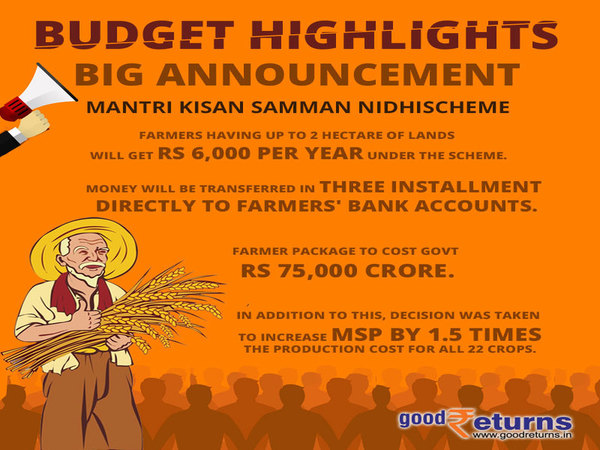

- Under the scheme Pradhan Mantri Kissan Samman Nidhi, each farmer will be allotted Rs.6000 per year in three instalments. This amount will be directly transferred to their bank accounts. However, this scheme is only applicable for farmers with a and holding of less 2 Hectares.

- Piyush Goyal even stated that farmers severely affected by natural calamities will get 2% interest subvention and an additional 3% interest subvention upon timely repayment.

Analysis: This move is aimed at the section of small and marginal farmer benefitting approximately 12crore of them. The estimated budget is of Rs75000 Crore. This is a form of direct income support.

Direct Tax System

- It is stated that in the coming two years, almost all assessment and verification of IT returns shall be done so electronically. All the work will be done through an anonymised bank office manned by tax experts and officials. There will be no personal interface between the taxpayer and the tax officer. FM Piyush Goyal also stated,” All returns will be processed within 24 hours and refunds issued simultaneously”.

Analysis: The result of this move will be to significantly simplify the direct tax system. It will also minimise intervention by tax officials. As all processing will be performed electronically, the chances of misrepresentation of facts or corruption will be significantly reduced.

Analysis: The result of this move will be to significantly simplify the direct tax system. It will also minimise intervention by tax officials. As all processing will be performed electronically, the chances of misrepresentation of facts or corruption will be significantly reduced.

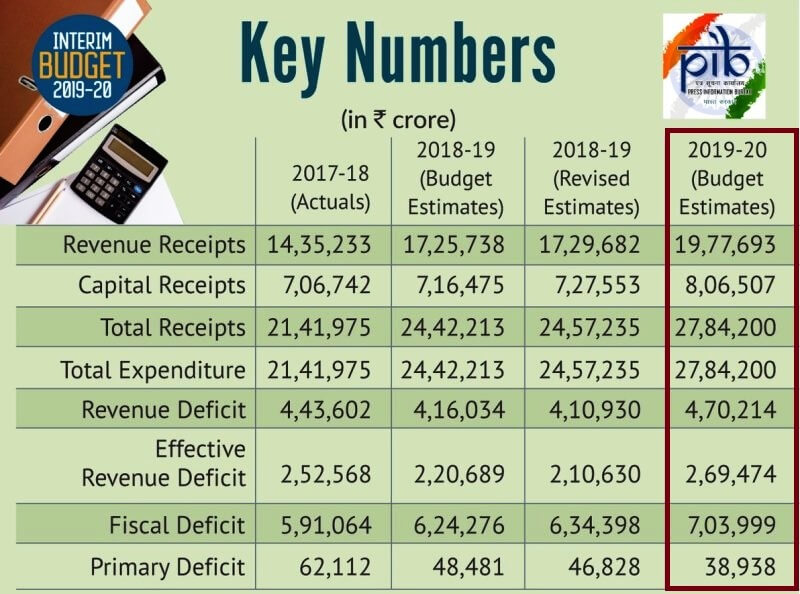

The Government also declared to maintain a 3.4% fiscal deficit for the Financial Year 2019-2020.

Other key changes in the budget

- Gratuity limit extended from Rs. 10Lakh to Rs.20Lakh.

- Interest Subvention on loans granted to MSMEs: It was announced that GST registered MSME units will receive 2% interest subvention on a financial loan of upto Rs.1Crore.

- Standard deduction raised from Rs.40,000 per year to Rs.50,000 per year.

- TDS Changes: No TDS in house rent increased from Rs.1,80,000 to Rs.2.4Lakh per year. No TDS on bank and post office interest from Rs10,000 up to Rs.40,000.

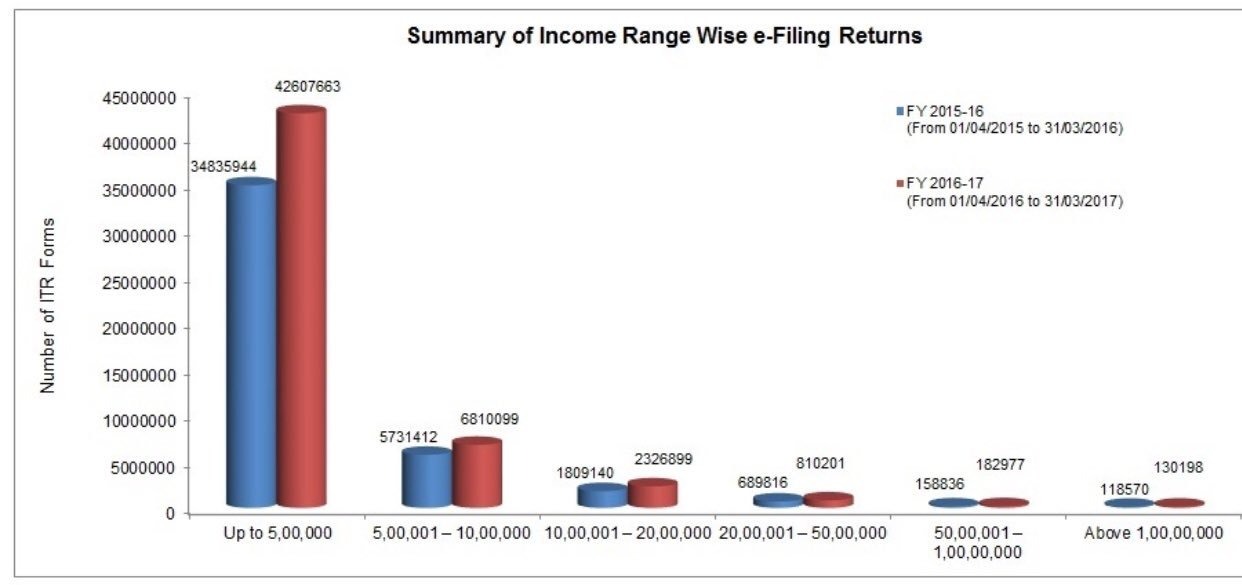

- Increase in Direct Tax Collection: There has been an increase in direct tax collection from Rs6.38Lakh Crore in 2013-14 to upto almost Rs.12Lakh Crore presently.The number of returns filed have also increased from Rs.3.79 Crore to Rs.6.85 Crore. This has shown 80% growth in tax base.

Stock market analysis

The Sensex rose by 444 points after the declaration of the interim budget 2019 on February 1st. The budget indicated an increase of growth in the market for the following sectors, Real Estate, Auto and FMCG. However, the market is volatile and and there are constant fluctuations. Therefore nothing can be promised in terms of growth before the 2019 General Elections.

Will the budget prove to be a source of redemption for the BJP?

The 2019 Interim budget has clearly been strategised to play the role of a game changer for the Modi government. It has been designed to appeal mainly to the middle income group while also keeping other sections of society happy. The middle income group will largely benefit from the policies in the budget. Not only has their tax margin increased but the amount of standard deduction has also been increased. However, the promises made by the government can be a perceived as over-enthusiastic as well. The government is likely to find its promise to maintain a fiscal deficit of 3.4% hard to maintain. That can be a tough task because of low revenue growth and higher expenditure as promised by the government. The government is likely to face rocky obstacles in its fiscal targets mainly due to its structural increase in expenditure.

As the government has promised direct income support to farmers and pension to retired workers in the unorganised sector, it has significantly raised the government expenditure. Since elections are nearing, all eyes are fixated on the deliverance of the government with respect to the budget. Any deviance from their promised path can be detrimental for the BJP leaving a negative impact on the masses. Although BJP has been held accountable for not delivering on their promises in the past tenure, their efficient planning and implementation on these promises can prove to be a game changer for the Modi government.